UD #00: Age of Deployment

A newsletter about technology, entrepreneurship, and VC in emerging markets.

This newsletter is supported by Rally Cap Ventures, a venture collective investing in early-stage fintech across LatAm, Africa, and Southeast Asia. Rally Cap’s exclusive global community is powered by strategic LPs, from companies such as Stripe, Plaid, Jumia and MercadoPago. Rally Cap was founded by Hayden Simmons.

In 2015, I responded to a tweet from a founder looking to hire ‘geniuses’ and ended up joining hotels.ng. The company was building bookings.com for Nigeria. It offered 'pay on arrival' as a payment method and fulfilled reservations by placing multiple phone calls to both the customer and the hotel. Other than those adjustments, it was essentially replicating the bookings.com model in Nigeria.

At the time I joined Hotels.ng, there were many other companies trying to replicate successful Silicon Valley models in Nigeria. Two groups that most exemplified this approach were Spark and Rocket Internet, which happened to be locked in competition across multiple verticles. At the time, Rocket had launched Carmudi, Lamudi, Jovago, Jumia Food and Jumia, which were marketplaces for cars, apartments, hotels, food, and consumer goods respectively. Spark, on the other hand, had invested in a series of ‘dotng’ businesses that were taking everything online including hotels, apartments, drinks, and buses. These were all online marketplaces of the kind that had already become hugely successful in Silicon Valley. Just like hotels.ng, the primary differences were some sort of cash payment option and a more hands-on order fulfilment system.

These experiments had mixed results. We learned that the adjustments made to the business models were too small to truly account for local realities, yet large enough to introduce significant friction into the customer experience. We also learned that Nigerians are poorer, less educated, and have less access to the internet than our peers in other developed markets and that this affects how we engage with digital products (Quelle surprise!).

The Nigeria tech sector in 2021 looks very different from the one I joined in 2015. For starters, there are fewer companies using ‘dotng’ domain names. But more importantly, companies are starting to realise that providing a digital layer on top of a broken value chain is not enough, you often have to go deep and fix large parts of the value chain.

Carmudi (now rebranded as part of Jumia Deals) was launced in 2013 and is primarily a classified website for connecting buyers and sellers. Autochek, was launched this year by Etop Ikpe. Etop has been operating in Nigeria’s e-commerce space since it’s earliest days and Autochek is the result of many of the lessons he has picked up over that time. Autochek doesn’t just connect buyers to sellers, it is an active participant across the value chain. The company will buy a sellers car at a price determined by its historical data and hold the car until it finds a buyer. When it finds a buyer, it also provides financing, insurance, and maintenance services. Contrasted with Carmudi, Autochek is operating more actively across the entire value chain.

Autochek’s model isn’t unique to Nigeria. Carsome (Malaysia), Carro (Singapore), and Cars24 (India) all run a similar model. This points to a broader trend in Nigeria’s ecosystem. Today’s founders are just as likely to be influenced by Meituan Dianping, GoJek, Grab, and Nubank, as they are to be influenced by Doordash, Uber or Chime. Founders are just as likely to go on learning trips to China or Indonesia, as they are to go to Silicon Valley. Even Rocket Internet has combined all its various online marketplaces in Africa into one ‘Super App’, a model closer to Meituan Dianping than it is to Amazon or eBay. These days, Rocket spends quite a bit of time talking up Jumia Pay, it’s Alipay clone.

Gradually, then suddenly

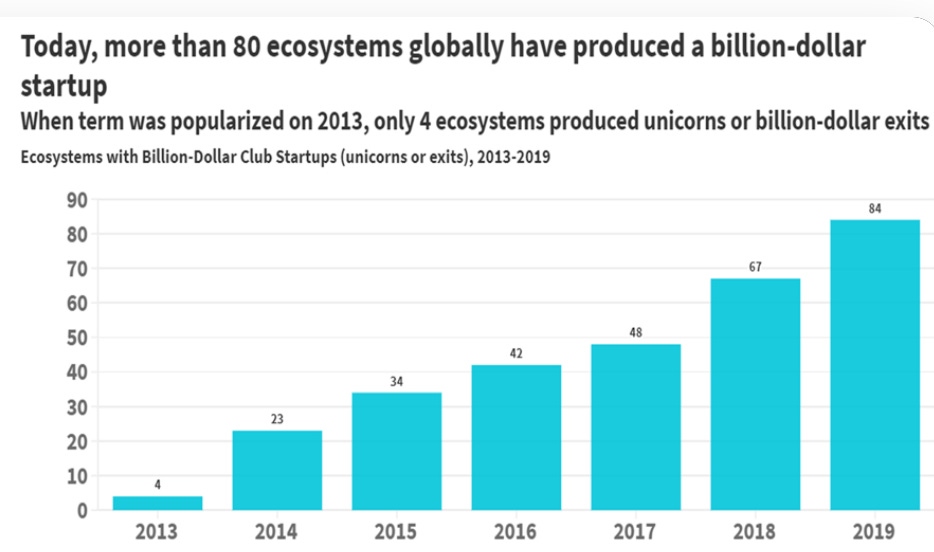

Over the last two decades, the centre of technology entrepreneurship and venture capital has gradually shifted towards the East. Increasing amounts of capital have flown into ecosystems outside of the USA. When Aileen Lee coined the term unicorn, they were mythical creatures primarily spotted in San Francisco. Today, unicorns are popping up everywhere from Manilla to Mexico City to Montevideo.

Carlota Perez proposes that technology revolutions all go through two distinct phases, the installation phase, which is when the technology is just being developed. At this stage, the technology is usually focused on one market and funded primarily by financial capital, which is comfortable with the risk involved in new technologies. The next phase is the deployment phase, which is when the technology has largely been proven in its core market. One trend that occurs in the deployment phase is that the technology starts to spread rapidly across the world. Today, the internet is well into the deployment phase.

The first industrial revolution began in Britain in 1760, but the only way you’d know that is by picking up a history book. Silicon Valley, which birthed the information revolution, still remains the centre of it today. Over the next few decades, Silicon Valley’s dominance of the innovation economy will come to resemble Britain’s current dominance of the industrial economy (i.e. Britain doesn’t dominate the industrial economy).

Chinese Whispers

If you’ve ever played the game of Chinese Whispers, then you’re familiar with how a single word or sentence can transform into something entirely different as it travels from one person to another. Business models behave the same way, evolving slightly as they travel from country to country. What this newsletter aims to do is to recreate that moment at the end of a game of Chinese Whispers, when the original word is revealed and the various mutations are traced. I’m attempting to reverse engineer that game of Chinese Whispers that connects Shihuituan, Telio and TradeDepot or Gojek, Rappi and MAX Okada.

The diffusion of technology is also being driven by large tech companies. The acronym companies (aka big tech) and companies like Uber, Stripe, Tencent and Alibaba, are increasingly engaging with and investing in the world outside of their home markets. In some cases, they are able to transfer their business models almost wholesale into these new markets. But more often than not, they also go through mutations as they cross borders.

Entrepreneurs like to believe that they are building the future. I tend to agree more with William Gibson that the future is already here, it’s just unevenly distributed. This newsletter aims to cover the diffusion of technology, entrepreneurship, and venture capital in emerging markets. Twice a month, I’ll send you a piece that will include a mix of original commentary, curated resources, and/or perspectives from operators & investors.

I’m launching Unevenly Distributed with a three-part series covering the three most important venture capital funds in emerging markets.

If this sounds like something you’re interested in, then please subscribe, share on social media, or forward to your friends.

Why I partnered with Rally Cap Ventures

Rally Cap Ventures is a venture collective investing in early-stage fintech across LatAm, Africa, and Southeast Asia. Rally Cap’s exclusive global community is powered by strategic LPs, from companies such as Stripe, Plaid, Jumia and MercadoPago.

The fund leverages its global founder/operator expertise, capital and networks to source and invest in the next generation of fintech infrastructure -- the APIs and platforms enabling financial services to truly scale, both within home markets and across their regions. Rally Cap was founded in 2020 by Hayden Simmons.

Unevenly distributed will sometimes have interviews with members of the community and the companies & fund-managers that Rally Cap invests in. I will also frequently share updates, news, and opportunities from the Rally Cap community

Well done, Derin!

Great piece, subscribed & looking forward to reading what comes next.