The promise of the internet is unencumbered distribution. Kind of. The reality is that the reach the internet provides you depends on what you are trying to distribute. For physical products, your effective reach is likely to be local, or regional at best. For financial services, your reach is unlikely to exceed a handful of regions. The internet's promise of truly unencumbered, global distribution is only fulfilled when the product is purely software.

However, even though you can sell software to anyone anywhere in the world, it hasn’t necessarily been the case that you could *start* a global software business from anywhere in the world. There are a handful of exceptions like Spotify, Skype, UiPath, and Auth0 (Endeavor company), but the vast majority of software businesses still tend to emerge from Silicon Valley.

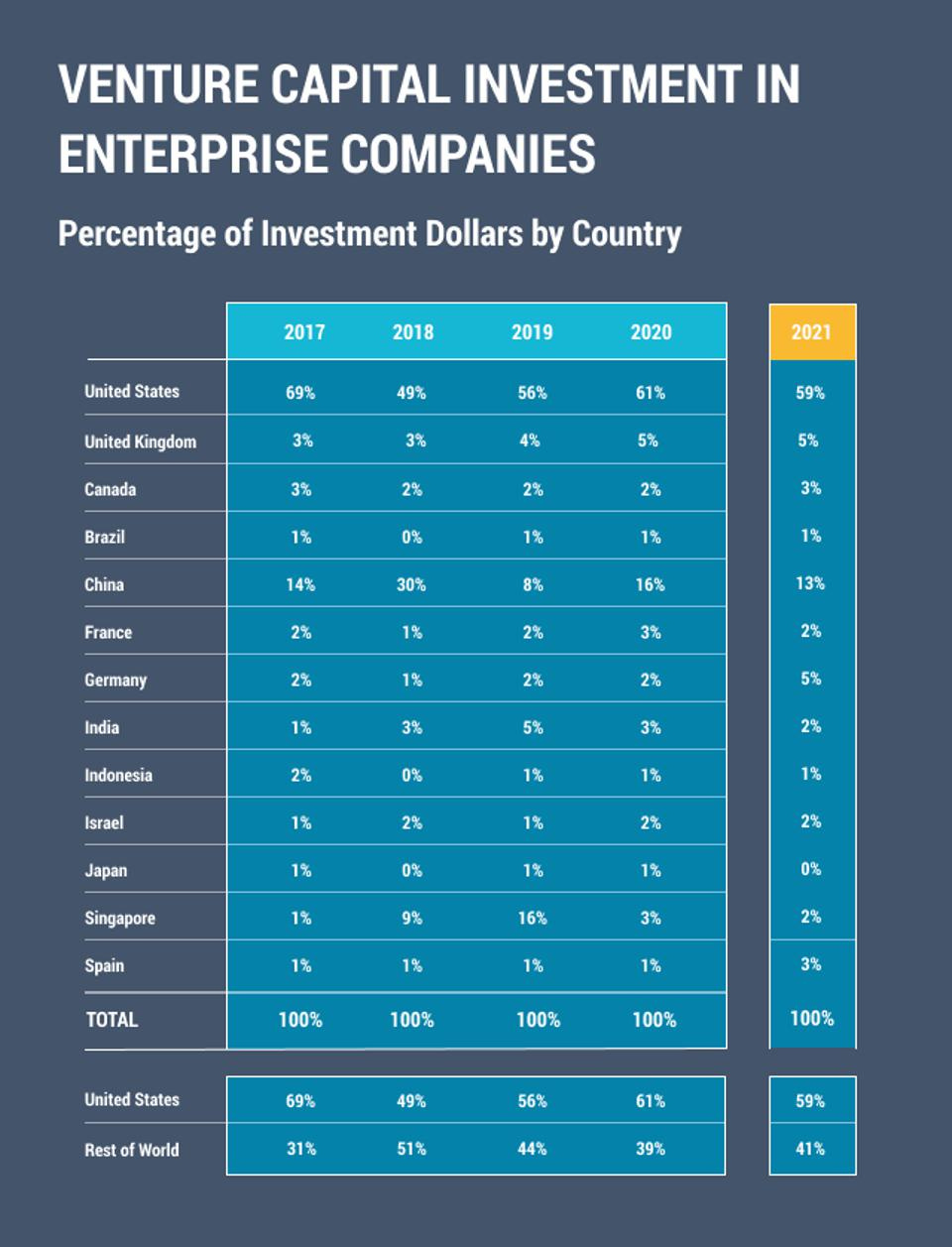

70% of global IT spend is outside of the USA, yet only 41% of investment in enterprise software businesses is outside of the USA. It is still the case that to build a global software business, you need access to finance and talent that is still largely concentrated in San Francisco. Outside of SF, particularly in emerging markets, the majority of investment goes to fintech or marketplaces, which by nature are often localized products. But software businesses do exist in these markets. They’ve just had to evolve to operate in a market that isn’t awash with capital and talent. In this Rest of World article, Joanne Yuan, of turn/river ventures, talks about her fund which specializes in investing in bootstrapped software businesses operating outside of Silicon Valley (link).

It could happen anywhere

If you had a magic wand and wanted to increase the chances of global software businesses emerging from anywhere in the world, you’d probably force VCs to invest and conduct due diligence over Zoom. Then you’d wave your wand again to make more companies embrace working from home and remote work.

Of course, all of this has happened in the last ~18 months. There have also been more secular trends like the rise of open-source software, increasing availability of venture capital in markets across the world, and the shift to software products that are pulled into companies by developers (vs pushed to companies through salespeople). It’s now increasingly likely that the next billion-dollar enterprise software companies will be born outside the US. In this Forbes article, Glenn Solomon (Managing Partner, GGV), lays out to case (link).

Index goes global

Index is one of the top European funds. It’s the most active investor in European decacorns - many of which it invested in at the Seed/Series A stage. A big part of the fund’s initial value proposition was helping European companies break into the USA. It scored wins like Skype (Estonia), Zendesk (Denmark), and Supercell (Finland). Index later decided it could also help in the reverse direction and invested in companies like Notion, Dropbox, and Slack.

It recently announced two new funds, in a blog post titled ‘Index Raises $3.1 Billion to Support New Wave of Founders, Everywhere’. From the post:

While the pandemic was devastating in so many ways, COVID-related restrictions created an opening for founders to re-imagine our world, transcending physical boundaries. Companies and people had to adapt to the digital world seemingly overnight, challenging the established norms of the traditional work contract. This phenomenon really resonated with us at Index, as we’ve always seen ourselves as a distributed, global company. It’s been thrilling to witness a fresh generation of founders, with bolder, more global ideas and endeavours. Driven by values, a desire to make a positive impact, and a commitment to co-create a better collective future, the companies that emerge from this era will be the force that shapes the decades to come.

With $3.1 billion in new funds we’re excited to support this next wave of founders, across all stages and geographical locations.

If this all sounds familiar, it’s because it’s very similar to what Accel wrote in their blog post covering their new funds. Which I wrote about in the last newsletter (link).

The unofficial slogan of this newsletter is that the internet is going to transform every sector in every country. In an interview that accompanied the announcement post, Index founding partner, Mike Volpi said “we're going to see innovation happening in unexpected places, in terms of both sectors and geographies”.

I couldn’t agree more.

Other links

There are roughly 100 Indian unicorns. An increasing number of them are planning to go public this year. Zomato was the first Indian unicorn to go public as it raised $1.3B in an IPO that valued the company at $8.6B. The IPO was fully subscribed, as existing investors had already provided 45% of the money it planned to raise in it’s IPO. (link)

Zomato’s main rival, Swiggy, raised $1.5B led by Softbank and Prosus (formerly Naspers). (link)

As is common with these platforms, the restaurants on them have complaints - mostly about commissions and access to customer data. (link)

Rappi (Endeavor Company) raises $500M at a $5B valuation (link). Timely overview of the company by Mikal Khoso (link).

Indian social commerce platform, Meesho raises $300M from Softbank at a $2B valuation. (link)

Apparently, if you want to build a super app, the first step is to begin your product’s name with ‘Go’. You know, just like Go-jek. The second step is to issue a press release. Gozem (link) and Gokada (link) are off to a great start.

Flipkart raised a bunch of money from Tiger Global, Softbank, Tencent, and other investors before selling 77% of the company to Walmart for $22B in 2018. Now it has raised money from Tiger Global, Softbank, Tencent, and a bunch of investors including Walmart at a $38B valuation. The plan is to list the company in the near future (link).

A conversation on the LatAm fintech ecosystem with Rafael Carvalho, Head of Credit Analytics for Nubank Mexico (link).

MENA is having its moment (link).

In Chicken or the Exit, I made the argument earlier that Africa does not have an ‘exit’ problem. Juan Gabriel agrees with me. Be like Juan Gabriel (link).

There’s a pipeline of emerging market consumer internet companies going public and the early signs are encouraging (link).

Emerging markets enthusiast podcast episode with René Lomelí, Partner at 500Startups for Spanish-speaking LatAm (link).

In 2015 and 2016, 90% of disclosed startup investments in Kenya went to teams with a European or American founder. Unfortunately, not much has changed. (link)

In an earlier edition, I wrote about Nigeria’s Mobile Money Moment. In this piece, Abubakar Idris writes about the growing agency banking sector in Nigeria. (link)

Interview with Matias Muchnick, founder of NotCo (Endeavor company) - a vegan food company that uses AI to match animal proteins to their ideal replacements among thousands of plant-based ingredients. The company has launched products such as NotMilk, NotBurger, NotIceCream, and NotMayo in five markets across the Americas. (link)

Accion on its investment in Dinie (Rally Cap Portfolio), which combines embedded finance and SME digitisation. Two of the infinity stones of emerging markets consumer internet. (link)

Sequoia has announced its first deal in Latin America, since it’s blog post on the opportunity in Latin America. The firm invested $1M in a seed extension for Pomelo (Rally Cap Portfolio company). (link)

There are lots of exciting updates and job opportunities across the rally cap portfolio.

Africa

has now successfully verified 40m+ customer transactions

devs can contribute to a plug-in/SDK library

launched a new dashboard and expanded to Ghana

hiring a Head of Product in Cape Town

announced a Series A, led by Octopus Ventures

hiring a Creative Designer, Head of Design & Data Engineer.

Bloc (TechAdvance)

raising a new round to scale their BaaS APIs across Africa

hiring Technical Product/Project Managers in Kenya, Ghana and Egypt

Axis

founder Jacques Marco will be joining Rally Cap as a Venture Partner, leading the charge in Egypt

is currently going through Y Combinator and opened a waitlist for their API on Product Hunt

Rally Cap led Frain’s pre-seed round -- more to come!

LatAm

launched a new website

after raising a $43m Series A, belvo has 27 job openings, with a focus on engineering managers, PMs & recruiters

announced a $1m extension, led by Sequoia

hiring various roles, including GMs of Brazil and Mexico, Head of Infrastructure & Head of Cybersecurity

hiring CTO, Head of BD & Head of Credit Risk

Caliza

Asia