UD Round-Up #03: The Bounce Is Back

Mega rounds are back in Africa but some people are worried about frothiness

How much would you pay today, to own 10% of a bank which is going to become the largest bank in Nigeria within the next 10 years and the largest in Africa within the next 20 years?

If you’re Target Global or Valar Capital, the answer is $55M. The two investors co-led a $55M round in Kuda Bank that valued the company at $500M. (link)

Here’s Ricardo Schäfer, the partner at Target who led the round:

Babs and Musty are ambitious on another level. For them, it was always about building a pan-African bank, not just a Nigerian leader. The prospect of banking over 1 billion people from day one really stood out for me at the beginning.

Here’s Andrew McCormack, a general partner at Valar Ventures:

Kuda is our first investment in Africa and our initial confidence in the team has been upheld by its rapid growth in the past four months. With a youthful population eager to adopt digital financial services in the region, we believe that Kuda’s transformative effect on banking will scale across Africa and we’re proud to continue supporting them.

The Nigerian investor community is split on this deal. Only three Nigerian technology companies have hit a valuation above $500M - Interswitch, Flutterwave, and Jumia. Kuda hit this milestone much faster than the others and with significantly fewer revenues.1

Now, not many local funds are invested in Kuda Bank. Some of them might have seen the deal early and passed, others may not have even seen it at all. The company raised a $10M Seed round last November. The valuation was not disclosed but it’s probably safe to assume it was significantly less than $500M. So perhaps there are a few sour grapes behind the comments we’re seeing from some investors that missed on making high returns from investing early in Kuda. It’s important to note that Target Global led the seed, participated in the Series A round, and co-led the Series B round. Valar Capital led the Series A round and co-led the Series B round. So the valuation is almost entirely based on the assessment of these two investors.

Does that mean the valuation is unrealistic? I don’t think so.

The largest bank in Africa today by market cap is FirstRand bank, which is worth >$20B. The largest bank in Nigeria by market cap is GTB, and that’s worth ~$2B. So how then is Kuda Bank, which is barely 2 years old, and generating significantly less revenue worth $500M?

Well, that’s because Kuda’s valuation is based on the future, and there’s a reasonable argument to be made that it’s much better positioned for the next 20 years than GTB, maybe even than FirstRand Bank. For the rest of this blurb, I’ll focus on Kuda Bank’s position in Nigeria, mostly because international expansion is a big question mark for any company.

***

If you asked a Nigerian above 60-years-old what bank they use, they are likely to say First Bank, Union Bank, or Wema Bank. These banks can trace their origins to before Nigeria was an independent country, and so can many of their customers. If you asked a Nigerian below 40-years-old what bank they use, they are likely to say Stanbic IBTC, GTBank, Zenith Bank, or Access Bank. It might be hard to believe it today, but in the ‘80s, ‘90s, and early ‘00s, GTB and Access Bank were the ‘challenger banks’, taking on the more established existing banks. They innovated on their products and offered superior customer value propositions.

When GTB launched, it focused on delivering a superior retail banking experience. It also targeted young people and spent heavily on marketing. I remember how aggressively the bank targeted my friends and me when I was in university. Their efforts were wildly successful. Many of my peer group opened GTB accounts because it was easy to do so and the service was great (compared to other banks). We have kept those accounts as we’ve grown older, our earning capacity has increased, and GTB’s customer service quality has rapidly decreased.

People tend to choose the bank that is most innovative and customer-friendly at the time when they become financially independent. They stick with that bank for a very long time. My dad has been using the same banks for multiple decades, and I’ve been using my bank for close to one decade. From a standing start, Kuda Bank grew to ~1M users, within 18 months, by offering superior customer service, free transfers, and an effortless account opening process. Many of these customers will stick with the bank for decades. The largest bank in Nigeria by retail customer base is Access Bank. It has 30M users, 20M of which interact with it digitally. The only other bank with more than 10M digital customers in Nigeria is First Bank. GTB has 7M digital customers.

In Orange Chronicles, a book commissioned to mark GTB’s anniversary, the authors wrote about how one of the early innovations GTB brought to the banking sector was eliminating branch banking and allowing customers to perform most transactions from any branch. Customers previously had to perform most transactions at the branch they opened their bank account. Two decades on, Kuda Bank wants to eliminate branches entirely.

My dad’s generation banked with First Bank, Union Bank, and Wema Bank. When I was in university, my choice was largely between GTB, Access Bank, and Zenith Bank. My little sister is currently in university. She’ll be opening a bank account soon. She’s just as likely, if not more likely, to open a PiggyVest account and a Kuda Bank account as she is to open a Zenith or a GTB account.

Today, companies like Piggyvest, TeamApt, Kuda Bank are described as fintechs, digital banks, challenger banks, agency banks, etc. Within the next decade or two, they’ll grow to become the dominant players, with the most customers. We’ll drop the ‘digital’ or the ‘challenger’ labels, and they’ll simply be known as banks. How much do you think they’ll be valued at then?

The bounce is back

When the reality of the pandemic hit last year, we saw a flight to the familiar. The immediate reaction from investors was to focus on their own portfolios. It soon became clear that the pandemic would drive increasing digitisation, and governments across the world responded to the pandemic with generous economic stimulus. The fear, uncertainty, and doubt settled, investors gained confidence and started to make new investments again. First in founders they had existing conversations with, then in industries and markets they were already familiar with, and finally back to new markets and sectors.

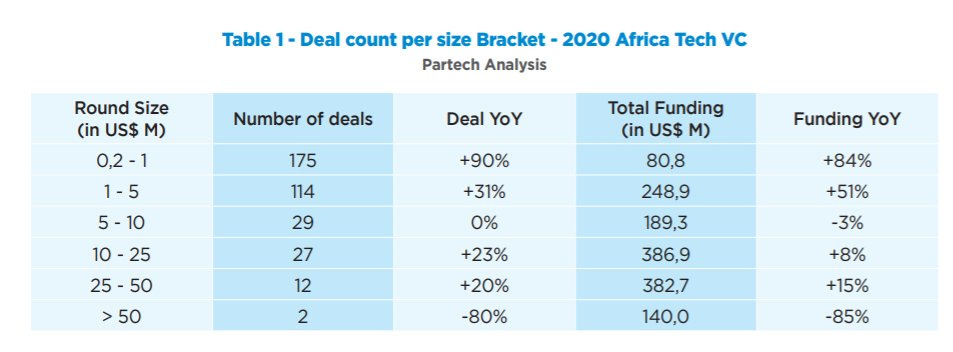

Funding in Africa last year was down due to the initial retreat. But if you looked closer, it was clear that the entire gap could be explained by international investors that write big tickets taking a step back in the middle of the pandemic. Local investors, which typically write smaller checks kept their activity numbers up. Funding was up at all levels except for rounds greater than $50M. There were only 2 rounds greater than 50M last year. This year, the large global funds are back. Investors like Tiger Global, DST, Valar, Insight, SVB, Ribbit, and Dragoneer have made investments into the continent this year alone. All as part of >$50M rounds.

Rabble Rousing

Last weekend, I read an article about the Nigerian fintech ecosystem in The Economist and I found it unnecessarily pessimistic, which was weird because it relied heavily on quotes from investors in the ecosystem. I wrote a quick rebuttal to the article. (link)

Other Links

South Korean digital bank, Kakao Bank, went public and its stock surged >70%, making it S.Korea's biggest lender by market value - link

Nubank co-led a $45M investment in Indian neobank Jupiter - link

Indonesian lending platform Kredivo (Endeavor company) to go public via $2.5B SPAC merger - link

Tidjane Thiam’s Spac in talks with Mexican fintech Credijusto - link

Credijusto only recently bought a bank - link

SA payments startup Yoco raises $83M Series C funding round by Dragoneer - link

Great podcast interview on the future of fintech in LatAm with Ana Cristina Gadala-Maria (QED Investors) - link

Fascinating history of Afterpay by Marc Rubinstein (Net Interest) - link

Really high-quality fintech deep dives for a broad range of geographies - link

Egyptian ride-sharing company Swvl (Endeavor company) plans to go public in a $1.5B SPAC merger - link

Used car sales platforms are taking over emerging markets. Unicorns in the space are emerging from every region. Great article on the model by Rest of World - link

Pair that article with this podcast episode with Carvana founder, Ernie Garcia - link

Nigerian start-ups live in constant fear of regulators - link

Article on the Nigerian government’s efforts to dampen the rise of crypto - link

Despite, or maybe because of these efforts, Nigeria (and Africa as a whole) has a thriving peer to peer crypto trading - link

Really great go-to-market playbook for expanding across the Asia Pacific region - link

A conversation on what it takes to build trust in your customer base by two Nigerian operators, Babajide Duroshola (Country Manager, M-Kopa) and Odunayo Eweniyi (Co-founder, PiggyVest) - link

NAZCA report on the Mexican VC ecosystem - link

Not entirely convinced by the arguments here, but an interesting comparison of the Brazilian and South African e-commerce and fintech markets - link

Fresh off the news of Rappi’s $500M round, that valued the company at $5B (link), a podcast episode with Rappi founder, Sebastian Mejia - link

How Zello keeps people connected during South Africa’s unrest - link

Free to read The Ken article on GrabPay’s monetisation conundrum - link

Very high-quality deep dive on Meituan’s product strategy - link

Colombia’s technology minister on outsourced jobs and the Fourth Industrial Revolution - link

Deep dive on Super Apps in Indonesia - link

Airtel Africa raises extra $200M for mobile money business - link

This is in addition to the $100M it raised from Mastercard (link) and $200M it raised from TPG’s Rise Fund (link).

There are lots of exciting updates and job opportunities across the rally cap portfolio.

Africa

has now successfully verified 40m+ customer transactions

devs can contribute to a plug-in/SDK library

launched a new dashboard and expanded to Ghana

hiring a Head of Product in Cape Town

announced a Series A, led by Octopus Ventures

hiring a Creative Designer, Head of Design & Data Engineer.

Bloc (TechAdvance)

raising a new round to scale their BaaS APIs across Africa

hiring Technical Product/Project Managers in Kenya, Ghana and Egypt

Axis

founder Jacques Marco will be joining Rally Cap as a Venture Partner, leading the charge in Egypt

is currently going through Y Combinator and opened a waitlist for their API on Product Hunt

Rally Cap led Frain’s pre-seed round -- more to come!

LatAm

launched a new website

after raising a $43m Series A, belvo has 27 job openings, with a focus on engineering managers, PMs & recruiters

announced a $1m extension, led by Sequoia

hiring various roles, including GMs of Brazil and Mexico, Head of Infrastructure & Head of Cybersecurity

hiring CTO, Head of BD & Head of Credit Risk

Caliza

Asia

It’s important to note that the numbers floating around were not released by the company and have not been verified.

I agree with your assertion that Venture firms pay for a piece of the future value of a company. While that is true, it is also true that the banks you compared Kuda to managed to grow while being profitable. A counter argument could be, so why isn't Kuda trying to do the same to some extent. I think the real problem is investment philosophy. A better comparison that highlights that is Facebook, in 2004 Facebook raised 500k USD with less than a million users and zero or close to zero revenue. The article that compares venture investing to funding whaling expeditions clearly outlines how venture investing works and I think more people need to read it.

Investors that value companies based on revenues, EBIT, and other typical PE metrics will struggle with the financials behind raises like Kuda. I think it's a good thing because it creates an opportunity to educate and possibly increase the number of people writing checks.